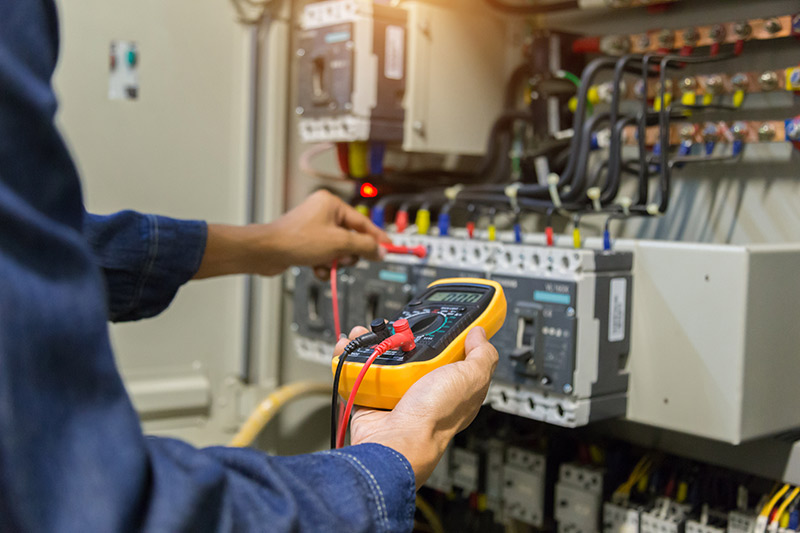

Electrical Equipment Financing

Simple application. Simple process.

Simple application. Simple process.

Electrical equipment can be costly. The good news is you can get it without using up your cash or burning through your credit line on a large one-time purchase. Just look to Balboa Capital for electrical equipment financing. We are a top-rated small business lender that makes the entire process simple and fast.

You can apply for equipment financing on our website in a matter of minutes. Then, if your application is approved and you decide to move forward, one of our helpful equipment financing specialists will contact you to discuss your options and answer any questions you have. Balboa Capital offers competitive rates, flexible repayment terms, and rapid funding, so get started now!

These are some of our minimum lending requirements, and meeting them does not constitute approval.

Should you apply for equipment financing, additional lending criteria will determine if you qualify.

Whether working on a large-scale job or a small residential project, you need top-quality equipment. Investing in new equipment for your electrician business is a good decision because it can set you apart from the competition. In addition, it enables you to replace old or outdated equipment that might be unreliable or unsafe.

The electrical equipment you finance might qualify for the Section 179 tax deduction. This IRS tax code was created specifically for small business owners to help encourage investment and provide a nice tax incentive. Ask your accountant or tax professional if the electrical equipment you want to finance is eligible for Section 179. Balboa Capital offers funding to finance all types of electrical equipment and even work vans, so get started now.

How to choose an equipment financing company

Learn what to look for in a business lender.

How to manage business profit

Learn tips that can help during slow or robust sales periods.

Year-over-year growth guide

Learn what YOY growth is, how to calculate it, and more.